2017 Tax Reform Comparision Chart

12/07/2017

On December 22, 2017, The Tax Cuts and Jobs Act was signed into law. The information in this article predates the tax reform legislation and may not apply to tax returns starting in the 2018 tax year. You may wish to speak to your tax advisor about the latest tax law. This publication is provided for your convenience and does not constitute legal advice. This publication is protected by copyright.

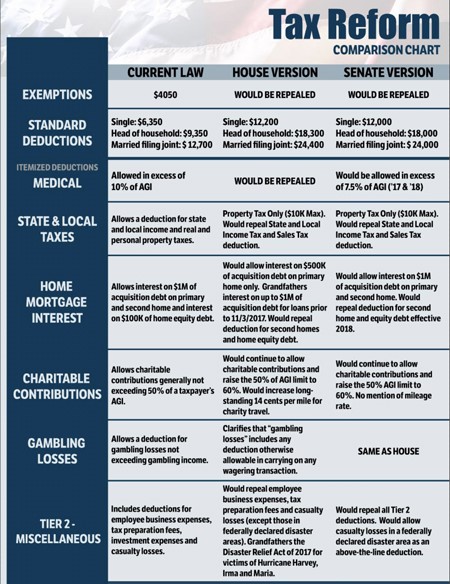

Tax Cuts & Jobs Act Individual & Small Business Side by Side Comparison

Provisions: This is a synopsis of some of the provisions included in the House bill (HR 1) that was passed by a vote of 227 to 205 on November 16, 2017, and the Senate’s version of the bill as passed on December 2, by a vote of 51 to 49 – both along party lines. This synopsis does not include any conference amendments made after the December 2nd Senate version.

There are significant differences between the two bills, and both the House and Senate must pass the same legislation before it can be sent to the president for a signature. This involves a reconciliation process between the two houses of Congress. Most sources expect that most of the provisions of the Senate version will prevail during the reconciliation process in an effort to get the legislation pushed through before Christmas. Both bills cut both individual and corporate tax rates Both bills largely repeal the state and local tax deduction Both plans increase the standard deduction Only the Senate bill repeals the Affordable Care Act requirement that individuals buy health insurance The conference committee will reconcile the two bills for a final vote and signature from the President

2017 Archives

LINDSTROM ACCOUNTANCY CORP.

2291 W March Lane Ste D105, Stockton CA 95207

(209) 451-0428 FAX (209) 451-0593

© web design by one eleven stockton, ca