Following Congress on its Path to Tax Reform

10/25/2017

On December 22, 2017, The Tax Cuts and Jobs Act was signed into law. The information in this article predates the tax reform legislation and may not apply to tax returns starting in the 2018 tax year. You may wish to speak to your tax advisor about the latest tax law. This publication is provided for your convenience and does not constitute legal advice. This publication is protected by copyright.

Article Highlights:

- Proposed Tax Reform Framework

- Filing Status

- Personal Exemptions

- Itemized Deductions

- Individual Tax Rates

- Child Tax Credit

- Alternative Minimum Tax

- Estate Tax

- Top Tax Rate for Small Businesses

- Expensing Business Purchases

As Congress begins debating tax reform, you might be interested in an overview of the GOP’s proposed changes so you’ll have an understanding of what the proposals actually entail as you follow the debate and won’t have to rely on politically motivated analysis by the various media sources. It is important to understand that the GOP’s tax reform proposal is actually only an overall framework of the tax legislation that will be formulated later by congressional committees. So it only provides the “big picture,” with details to be added later. However, the devil is always in the details, and you frequently have to read between the lines and listen to and read comments by Washington insiders to glean additional detail. Based upon that, the following are the provisions of the proposed tax reform that will apply to individual taxpayers and small businesses.

Filing Status

Current Law: The current law includes five filing statuses: single (unmarried), married taxpayers filing jointly (MFJ), head of household, married filing separately (MFS) and surviving spouse. The head of household (HH) status is for single individuals and some married but separated individuals who are maintaining a home for a dependent. MFS is a filing status that applies to a married individual who is not filing a joint return with their spouse (it keeps married individuals from filing as single and abusing the intent of the tax laws). Surviving spouse is a status that allows a widow or widower with a dependent child to continue to use the joint tax rates for 2 years after the year of death of their spouse.

Proposed Law: It appears that the proposal would retain only the single and married taxpayers filing jointly statuses in an effort to simplify the tax law. If this is the actual intent, it would greatly streamline the tax code, which is littered with special treatment for HH and MFS taxpayers. Potential losers under this proposal are HH filers, who currently enjoy a standard deduction that is higher than that of a single filer as well as lower tax rates.

Personal Exemptions

Current Law: A deduction from adjusted gross income (AGI), called an exemption allowance, is permitted for the filer of the return, his or her spouse if filing jointly, and each dependent claimed on the return. For 2017, each exemption allowance is $4,050. So, for example, a married couple filing jointly with two dependent children would be entitled to an exemption allowance of $16,200. However, the exemption deduction phases out for higher-income taxpayers.

Proposed Law: Personal exemptions would be eliminated, but child and other dependent credits might take their place, as described later in this article.

Standard Deduction

Current Law: The standard deduction is for taxpayers without enough deductions to file a Schedule A and itemize their deductions. Currently a standard deduction is set for each filing status and is adjusted for inflation each year. For 2017, the standard deduction is $6,350 for single and married separate, $9,350 for head of household, and $12,700 for married joint and surviving spouse. There are also add-on amounts for each filer and spouse who is age 65 or over, plus an additional amount for blindness.

Proposed Law: The GOP’s framework would replace both the current standard deduction and the personal exemptions with new higher standard deductions. In addition, the proposal would do away with the additional standard deductions for the seniors and people with visual impairments.

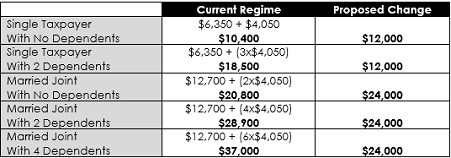

When the proposed higher standard deductions were first announced some months ago, those using the standard deduction were excited to think their standard deductions would be roughly doubled. But now that we have a few more details, we find that personal exemptions would no longer be allowed, which changes the outcome significantly. The table below compares the current standard deduction and exemptions for different filing statuses and number of exemptions to the proposed standard deduction replacement.

As you can see, the proposed change favors the smaller family size, but this is supposed to be compensated for with a larger and partially refundable child tax credit that is discussed below.

Itemized Deductions

Current Law: Medical deductions are allowed to the extent that they exceed 10% of the taxpayer’s AGI, tax deductions for state and local (city) income taxes or sales tax, plus real and personal property taxes. Also included is interest paid on qualified first and second home mortgage acquisition and equity debt, provided the acquisition debt doesn’t exceed $1 million and the equity debt isn’t over $100,000. The debt amounts of the first and second homes are combined for this limitation. Other categories of itemized deduction are charitable contributions and miscellaneous itemized deductions.

Proposed Changes: The tax reform would eliminate all deductions except for charitable contributions and those that encourage home ownership, such as home mortgage interest.

There is already pushback from members of Congress whose constituents reside in states that impose an income tax on their residents. Taking away the ability to deduct state and local income tax, referred to as the SALT deduction, would most significantly impact taxpayers living in states that have income taxes, and thus they would be double-taxed on the same income. All but seven states have income tax, with California, New York and New Jersey imposing the highest rates.

Eliminating medical deductions will significantly impact senior citizens who require expensive elder care and taxpayers who incur extraordinary medical expenses.

Casualty, theft and disaster losses are currently included in itemized deductions, and the proposal is silent as to what will become of these all-important deductions. Also unaccounted for is the deduction for gambling losses, the elimination of which will force recreational gamblers to pay tax on all winnings even if they have a net loss.

Individual Tax Rates:

Current Law: There are seven tax rates (10%, 15%, 25%, 28%, 33%, 35% and 39.6%), with the tax progressively increasing as the taxpayer’s taxable income increases. Each tax rate is applied to ever-increasing ranges of taxable income, referred to as tax brackets, with the 2017 top brackets kicking in at $418,400 for single taxpayers and $470,700 for married taxpayers filing jointly.

Proposed Changes: The tax reform would reduce the number of tax rates to three: 12%, 25% and 35%, with possibly a fourth rate for the “highest-income” taxpayers. The proposal is silent as to the ranges of taxable income these rates will apply to, making it impossible to make comparisons between the current law and the proposed changes. However, should the three rates be made into law, the wealthiest taxpayers would enjoy a significant tax cut.

Child Tax Credit (CTC)

Current Law: Allows a tax credit of $1,000 for each qualifying child dependent under the age of 17. The credit is generally nonrefundable (meaning it can only offset your tax liability and any excess is lost). However, when a taxpayer’s income is low or there are three or more qualifying children, a portion of the credit is refundable. The credit is also phased out for higher-income taxpayers.

Proposed Changes: The reform would increase the amount of the credit by an unspecified amount and make the first $1,000 of the CTC refundable. It would also add a nonrefundable credit of $500 for other dependents of the taxpayer that do not meet the child criteria. This presumably eliminates the current complicated calculation for the refundable portion of the child tax credit. The proposal intends that the income phaseout ranges be adjusted so more taxpayers will be eligible for the credit, but the higher phaseout levels are not specified. These adjustments to the CTC are touted to make up for the loss of personal exemptions, but without knowing the amount of the credit increase and the high-income phaseout ranges, it is impossible to make comparisons between the current and proposed regimes.

Alternative Minimum Tax (AMT)

Current Law: The AMT was originally initiated to keep higher-income taxpayers from benefiting from certain tax provisions. Over the years, inflation has caused the AMT to significantly impact more taxpayers than originally intended. Determining whether the AMT applies and computing the tax adds a layer of complexity to preparing the return.

Proposed Changes: The reform would eliminate the AMT.

Estate Tax

Current Law: The current code imposes a 40% tax on the estate of a decedent whose estate’s value exceeds $5.49 million. The $5.49 million is adjusted down for certain gifts made during the decedent’s lifetime. Beneficiaries of estates receive inheritances at the fair market value of the property inherited as of the decedent’s date of death. Thus beneficiaries who inherit property and then sell it are subject to tax only on the appreciation from the time they inherited the property.

Proposed Changes: The reform would eliminate the estate tax. Unanswered in the proposal is whether a beneficiary will continue to receive inherited property at fair market value or whether the heir will inherit the decedent’s basis in the property. If the latter, then when the beneficiary sells the property the beneficiary will be stuck with paying income tax on the entire appreciation in value from the time the property was acquired by the decedent. Also unanswered is whether the gift tax will continue to apply.

Top Tax Rate for Small Businesses

Current Law: At present, business income from a Schedule C, LLC, Partnership and S-Corporation is passed through to the owner of the business and included on his or her 1040 individual return and taxed at rates ranging rom 10% to 39.6%.

Proposed Changes: As mentioned previously, the proposed changes would reduce the current seven tax rates to three. For pass-through businesses, the proposed changes limit the tax on pass-through small business income to 25%, the middle rate of the three new proposed rates. Unfortunately, the term “small business” is not defined in the proposal. This proposed change would favor successful businesses that would otherwise be subject to the highest proposed tax rates.

Expensing Business Purchases

Current Law: Generally, capital purchases by a business, such as machinery, vehicles, or computer systems, must be depreciated (written off) over their useful lives—usually 3, 5 or 7 years for most purchases by small businesses. A special allowance, usually referred to as bonus depreciation, is available in the first year for certain types of property. There is also a provision that allows expensing up to $510,000 worth of purchases in lieu of depreciating the cost of the property.

Proposed Changes: The reform would allow 100% first-year expensing of capital purchases (other than structures) after September 27, 2017. The full expensing provision would not be permanent, but would be in the tax code for a minimum of five years. A future Congress could decide to extend the provision or make it permanent.

Other issues: Other issues generally not impacting small businesses or individuals include reducing the corporate tax rate to 20% – which is below the 22.5% average of the industrialized world – with the intent to make U.S. businesses more competitive with their foreign rivals. The corporate alternative minimum tax would also be eliminated. The proposed changes would also repeal the domestic production activities deduction and most business tax credits, except the low-income housing and the research and development credits.

The current consensus is that the changes, other than the business expensing, would not be effective until 2018. We hope this provides you with insight into the GOP’s proposed tax reform. But keep in mind that these proposals could, and probably will, change as the proposal works its way through Congress.

2017 Archives

LINDSTROM ACCOUNTANCY CORP.

2291 W March Lane Ste D105, Stockton CA 95207

(209) 451-0428 FAX (209) 451-0593

© web design by one eleven stockton, ca