Tax Reform and Your Taxes

12/26/2017

Article Highlights:

- Personal Exemptions

- Standard Deductions

- Itemized Deductions

- Medical

- Taxes

- Home Mortgage Interest

- Charity

- Casualty Losses

- Employee Business Expenses

- Tax Rates

- Child Tax Credit

Well, the Tax Cuts and Jobs Act (H.R. 1) has passed, mainly starting in 2018, and if you are confused by how this new law will impact you, you’re not alone. As has become the norm for Congress, it played brinksmanship and waited to almost the end of the year, in the midst of the holidays, to pass this very extensive tax bill, providing little time for anyone to plan for 2018.

So that you have an idea about how these changes might affect individual taxpayers like yourself, we have assembled some of the key points of the new law. As a suggestion, pull out your 2016 federal return and follow along to get a better understanding of these changes.

Personal Exemptions – (See 1040 Line 42, 1040A Line 26) In the past you were able to deduct a personal exemption amount for yourself, your spouse (if married filing jointly), and anyone who you could claim as a dependent. For 2016 and 2017, that amount is $4,050. Under the new law, the deduction for exemptions has been eliminated.

Standard Deductions – (See 1040 Line 40, 1040A Line 24) Taxpayers can take a standard deduction or itemize their deductions if the itemized deductions provide a larger deduction. Under the new tax law, the standard deduction amounts are almost doubled, and the itemized deductions allowed have been scaled back. The chart below illustrates the standard deductions by filing status for 2017 and the amounts under the new law for 2018.

Itemized Deductions – (See 1040 Schedule A) Before this change in law, taxpayers were generally able to deduct medical expenses above a percentage of their income, various state and local taxes paid, home mortgage interest, charitable contributions, casualty losses, gambling losses to the extent of gambling winnings, and, if the total of the category was greater than 2% of their income, employee and investment expenses plus other infrequently encountered deductions. The following will look at the changes to these deductions made by the new law.

- Medical Deductions – (Schedule A – Line 4) Individuals can still deduct their medical expenses to the extent they exceed a percentage of their income (AGI). This income limit has been reduced from 10% to 7.5% of AGI for years 2017 and 2018 and returns to 10% in 2019.

- Taxes – (Schedule A – Line 9) Prior to the change in law, taxpayers were allowed to deduct state and local income taxes, or sales tax if larger, real property taxes, and certain personal property taxes. Under the new law, these taxes are still deductible, but the overall tax deduction is limited to $10,000. State income tax represented a very large deduction for many residents of states with high state income taxes, and modifying the deduction was a big bone of contention, as it was being debated in Congress.

- Home Mortgage Interest – (Schedule A – Lines 10-12) Under the old tax law, a taxpayer could deduct the interest on up to $1 million of acquisition debt for the purchase of the taxpayer’s first and second homes. In addition, taxpayers were allowed to deduct the interest on up to $100,000 of home equity debt. The new law reduces the $1 million limit on home acquisition debt to $750,000 ($375,000 for married separate filers) for first and second homes, except the lower limit won’t apply to indebtedness incurred before December 15, 2017. That is, the $1 million cap continues to apply to acquisition mortgages on a primary and second residence already in existence prior to December 15, 2017. However, starting with 2018 returns, the new law does not permit a deduction for any equity debt, which can have an adverse impact on individuals who have used their home equity to pay for costs of tuition, travel, cars, and other purposes.

- Donations to Charities – (Schedule A – Line 19) The new law continues to allow a deduction for charity contributions and even raises the general 50% of income (AGI) limit on charity deductions to 60%.

- Casualty and Theft Losses – (Schedule A – Line 20) Under the new tax law, no personal casualty losses will be allowed except those incurred in a federally declared disaster area.

- Job Expenses and Certain Miscellaneous Deductions – (Schedule A – Line 27) This category is no longer deductible under the new tax law.

- Overall Limit on Itemized Deductions – The new law suspends from 2018 through 2025 the rule requiring higher-income taxpayers to phase out their total itemized deductions once their AGI exceeds certain threshold amounts.

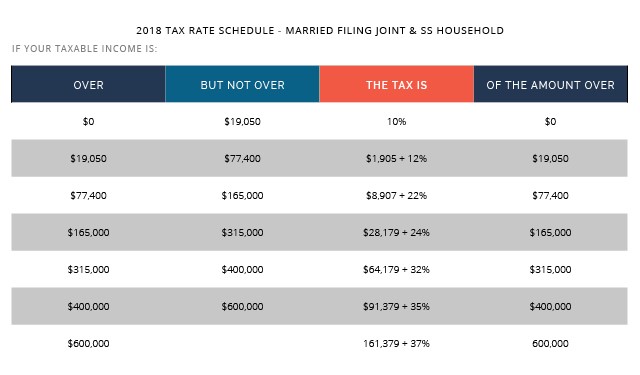

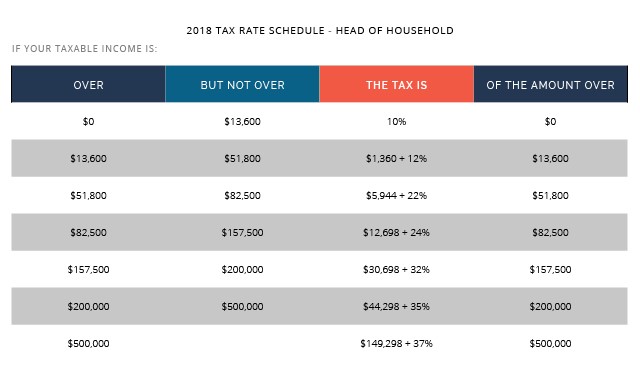

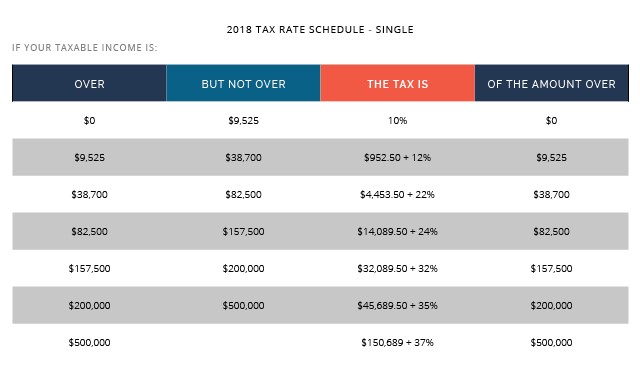

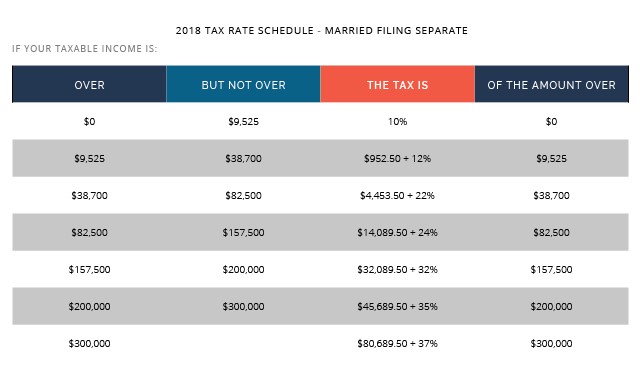

Tax Rates – (See 1040 Line 44, 1040A Line 28) Under the new tax law, the income tax rates have been substantially modified, and the following tables can be used to determine the tax for 2018.

Child Tax Credit – (See 1040 Lines 52 and 67, 1040A Lines 35 and 43) The Act enhances the child tax credit (CTC) by increasing the credit per eligible child from the current $1,000 to $2,000 with up to $1,400 being refundable. The Act adds a nonrefundable non-child dependent tax credit of $500 for each dependent who does not qualify for the CTC.

The AGI thresholds at which the credit begins to phase out are substantially increased to $400,000 for married filing jointly and $200,000 for all other taxpayers, up from $110,000 for married joint, $55,000 for married separate, and $75,000 for all others.

SSN Requirement – To receive either the refundable or nonrefundable child tax credit, a taxpayer must include on the return a Social Security number that was issued before the due date of the return for the year for each qualifying child for whom the credit is claimed.

Of course, there is a lot more to the new tax law than is covered here, including some complicated business changes, such as a new deduction for qualified business income from S-Corporations, partnerships, and sole proprietorships. If you would like to schedule a tax planning appointment, please give this office a call.

2017 Archives

LINDSTROM ACCOUNTANCY CORP.

2291 W March Lane Ste D105, Stockton CA 95207

(209) 451-0428 FAX (209) 451-0593

© web design by one eleven stockton, ca