Why Do Small Businesses Fail, and How Can I Prevent This?

02/20/2017

On December 22, 2017, The Tax Cuts and Jobs Act was signed into law. The information in this article predates the tax reform legislation and may not apply to tax returns starting in the 2018 tax year. You may wish to speak to your tax advisor about the latest tax law. This publication is provided for your convenience and does not constitute legal advice. This publication is protected by copyright.

Many people dream of starting a small business. This is a dream that can become a reality, or—as happens to about 33% of prospective business owners, according to the Small Business Administration – it can result in dismal failure within two years. There’s no magic-bullet solution to ensure a successful business, but if you don’t want to be in that 33%, you should be aware of the common reasons that small businesses fail.

1. Poor cash flow.

Uneven, unstable, or nonexistent cash flow is the #1 killer of small businesses. New business owners are liable to run into this problem because they have few or no paying customers and because they must overcome an onslaught of new expenses to keep their doors open. Depending on the type of business, the impact can be severe (particularly for brick-and-mortar businesses that must pay rent).

Heavily project-based businesses are also apt to run into cash-flow problems if getting paid takes too long, as the bills don’t stop coming due. Before trying to predict income, sit down with an accountant to forecast your expenses so that you know how much savings you should have on hand and how much capital to seek.

2. Lack of managerial experience.

Say that you have decided to open a specialty bake shop because you’re an incredibly talented pastry chef. You may know how to pipe a macaron better than the old French masters, but that doesn’t mean you know how to run a bake shop. Many talented individuals are fantastic at the chief service or product that their business offers but lack the business insight they need to make it succeed.

An MBA is not needed to run a business, but it certainly helps to take business courses dedicated to the appropriate industry and to enlist a small-business consultant to help draft a business plan and put it into action. Talk to other business owners of all types and learn from them; ask them what they would and wouldn’t do again when running their businesses.

3. Not providing what the market wants. There’s a reason that small-business ownership is just a dream for some people; often, a person’s dream career just is not realistic because it does not have a market. If you live in a small town and want to open a formal dress shop, you should ask, “Do the people in this town have the income and tastes to present sufficient demand, or would a big city have a better market?”

Whether businesses target local or general markets, the inability to find a customer base is often what causes them to fail, despite their owners’ love. Do some market research first before deciding to invest in a business or start a new product line. Such research takes time and money, but it can prevent a major loss—or reveal a major opportunity in a different place or another line of work.

4. Not keeping up with the pace of growth.

Have you ever heard of “the law of diminishing returns”? It refers to the inability to keep up with growth—both forecasted and unexpected. This problem causes a lot of business owners to crash and burn. When a business has been in famine mode for years because of cash-flow issues but suddenly begins to take off, it can be difficult for its owner to change his or her attitudes about money.

When a business grows, it eventually needs to hire help to keep up with the number of customers, as the owner can’t do it all; if this doesn’t happen, the business will start to lose money. Is that slow, old computer taking up too much time on high-value gigs and preventing work from getting done faster? Invest in both people and equipment when the time comes. Don’t fall victim to the law of diminishing returns.

5. Not Learning From Failure

Even the wealthiest business owners in the world have had failures, whether they are projects or entire companies. They got to where they are by learning from their failures.

Based on the common causes of business failure outlined above, if the market doesn’t want your product, you must adapt. If a lack of time or poor-quality equipment are holding you back, you must hire help or invest in faster computers and more efficient machinery.

It’s only truly a failure if you do not learn from your mistakes.

By getting a proper handle on your finances and properly managing of all of your resources (including labor), you can drastically increase the chances that your business will succeed. Sometimes, the market is just fickle, requiring you to adapt to changing demands and technologies. By being prepared for all the intricacies of running a business and by having the wisdom to learn from failure, your business won’t be among the 33% that fail in the first 2 years.

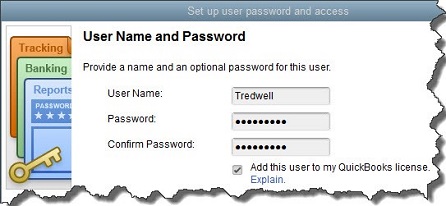

To give an employee access to QuickBooks, enter a User Name for him or her here, then a password.

The Set up user password and access window will open. Fill in those fields and check the box in front of Add this user to my QuickBooks license. This will not be an option if you already have five users, since that’s the maximum number allowed by QuickBooks Pro and Premier. To buy more, open the Help menu and select Manage My License, then Buy Additional User License.

Tip: If you’re not sure how many user licenses you’ve purchased, hit your F2 key and look in the upper left corner. If you’ve maxed out and need more licenses, talk to us about upgrading to QuickBooks Enterprise Solutions.

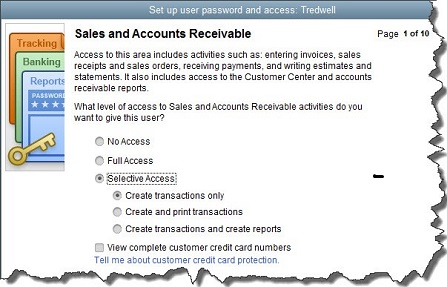

Click Next. In the window that opens, you’ll define the access level for your new user. Your options here are:

- All areas of QuickBooks,

- Selected areas of QuickBooks, or,

- External accountant (you can grant us access to all areas of the software except for those that contain sensitive customer data, like credit card numbers).

Click the button in front of the second option, then Next.

You can specify the access rights for individual employees in numerous areas.

The image above shows the first screen of 10 that display the levels of access available in many individual areas of QuickBooks. Be sure to read the whole page carefully before assigning rights. Here, for example, you’re not just allowing the employee to enter sales and A/R transactions. You’re also deciding whether to grant him or her permission to view the Customer Center and A/R reports. As you can see, your options are No Access, Full Access, and Selective Access (three levels there). Check the box below this list if you want the employee to be able to View complete customer credit card numbers.

When you’re finished there, click Next to specify your similar preferences for Purchases and Accounts Receivable, Checking and Credit Cards, Inventory, Time Tracking, and Payroll and Employees. The next two screens contain more complex concepts, but you’ll follow the same process to express your wishes. They are:

- Sensitive Accounting Activities, like funds transfers, general journal entries, and online banking tasks

- Sensitive Financial Reporting, which allows access to all QuickBooks reports. The option you choose here overrides all other reporting restrictions that you’ve specified for the employee.

Finally, you’ll tell QuickBooks whether this person can change or delete transactions in designated areas, and whether he or she can do so to transactions that were recorded before the closing date (if this applies). The last screen displays a summary of the access and activity rights you’ve given the employee. Check them carefully, and if they’re correct, click Finish.

Housekeeping Options

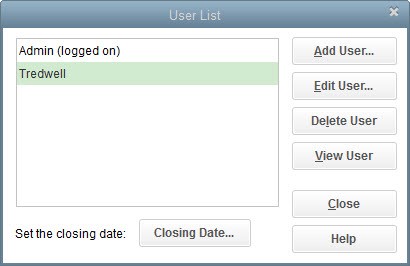

The User List window

QuickBooks then takes you back to the User List window, where you’ll see the employee’s name displayed. If you want to Add, Edit, Delete, or View a user, make sure the correct name is highlighted and click the button for the desired action.

If you’re just now looking to add your first employee to QuickBooks or if you’re starting to outgrow the five-user limit, give us a call. There are more issues to consider when you take on multi-user access. We’d be happy to discuss them with you.

2017 Archives

LINDSTROM ACCOUNTANCY CORP.

2291 W March Lane Ste D105, Stockton CA 95207

(209) 451-0428 FAX (209) 451-0593

© web design by one eleven stockton, ca