Where Do You Fall In The Tax Pecking Order?

03/13/2018

Article Highlights:

- 2015 Overall Filing Statistics

- Statistics by Adjusted Gross Income

- Percentile Table

Ever wonder where your income puts you in comparison with the rest of the U.S. taxpayers? Each year the Internal Revenue Service publishes a Statistics of Income Bulletin. The latest set of figures is for 2015 tax returns and provides some interesting statistics.

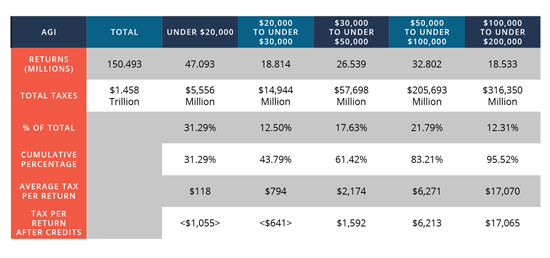

For 2015, taxpayers filed 150.49 million individual income tax returns, which was an increase of 1.27 percent over the 148.6 million returns filed for 2014. The total gross income of the 150.49 million 2015 returns was $10.21 trillion, which was a 5.8 percent increase over 2014.

In the chart you will notice that the first two columns include taxpayers with a total gross income under $30,000 – they as a group comprise 43.79% of all taxpayers for 2015. You will also notice that these two categories, as a group, do not pay any income tax, and because they qualify for a number of refundable credits, they actually receive refunds. These refundable credits are the earned income tax credit, child tax credit and American Opportunity Tax Credit.

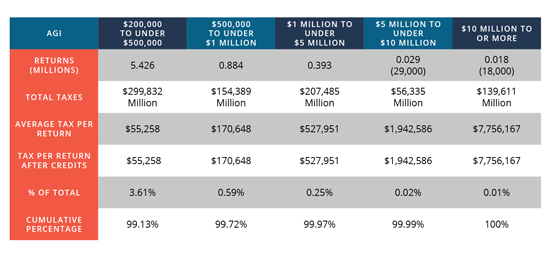

If you are not sure which category you are in, you can find your AGI on line 37 on your 1040 or line 4 of the 1040-EZ, and then you can compare your situation with the table below.

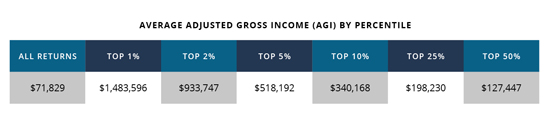

The IRS statistics for 2015 also included the following table that illustrates top income percentiles. For example, if your AGI is $340,168 or more, you would have been in the top 10% of all taxpayers.

To reach the top 1%, your AGI would have to be $1,483,596. There are approximately 95,150 taxpayers in the top 1% group. Compare that to 1% of the total number of taxpayers filing, which is 1,412,000, and you can see it is a pretty exclusive club.

Hope you found this interesting. If you have any questions, please give this office a call.

2018 Archive

LINDSTROM ACCOUNTANCY CORP.

2291 W March Lane Ste D105, Stockton CA 95207

(209) 451-0428 FAX (209) 451-0593

© web design by one eleven stockton, ca